Triller offers BKFC as collateral for $10M convertible note

A mystery Grand Cayman entity may have future rights to Bare Knuckle.

Now we know why Triller filed an NT 10-K with the SEC to delay their annual earnings report.

And now we also know why Triller didn’t respond for comment when we reported behind-the-scenes rumors that interested parties were preparing to spinoff Bare Knuckle FC from Triller onto the NASDAQ as a publicly traded company.

Is Triller spinning off Bare Knuckle FC onto the NASDAQ?

Triller is on the hunt for investment cash and even bragged about going to Mar-A-Lago this past week to connect with the rich and famous. This is on the heels of declaring two months ago that they supposedly secured $50 million in new cash.

It turns out that Triller ended up modifying an equity deal with a recent investor.

No new info (yet) regarding their financial fishing expedition at Mar-a-Lago last week. Instead, they restructured a $10 million investment with KCP Holdings Limited in the Cayman Islands.

The original deal, dated January 24, 2025, between the mystery investors at KCP Holdings Limited, Roger C. Kennedy, and Triller was a $10 million deal for securities. The deal included a Director Indemnification Agreement for Mr. Kennedy. That’s been ripped up. According to the new Termination Agreement, Mr. Kennedy was never listed as a director for Triller. Litigation exposure concerns?

The new deal between the parties is a $10 million (convertible) Note Purchase Agreement with warrants (options) and collateral.

A maturity date of two years, prime rate + 2% (10.5%?) for interest (which can go up to 15% if there is any default in payment). A default is defined as either non-payment, NASDAQ delisting, or bankruptcy.

Transferable Warrants to be able to purchase up to 10 million common shares with a strike price of $1 per Triller stock share (expiring April 2030). Exercisable one year after a Qualified Equity Financing (as defined in the Note Purchase Agreement).

Collateral in case of default by Triller.

And what is the collateral? Triller’s shares in Bare Knuckle FC.

Here are the details of this new financial arrangement.

Last week, we covered the Bare Knuckle side of the equation with rumored attempts to explore spinning BKFC onto the NASDAQ using a QB non-shell. Today, Triller is using BKFC as collateral for a $10 million note that can be converted into future common stock shares. The deal is at least $9.5M, with up to $500k available to cover legal fees. Those legal fees are likely for Triller’s attorneys at Loeb & Loeb in New York. KCP’s investment cannot be used by Triller for litigation-related purposes, like legal settlements.

Triller currently has hundreds of millions of dollars in liabilities. This new deal with KCP is a risk for equity (stock) dilution.

Complicating debt matters with Triller is a Subordination Agreement with a Chinese entity called Giant Wisdom Ventures Limited.

Somebody always knows something

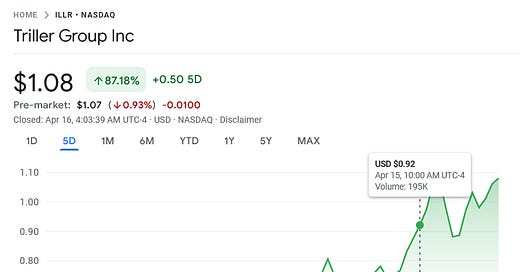

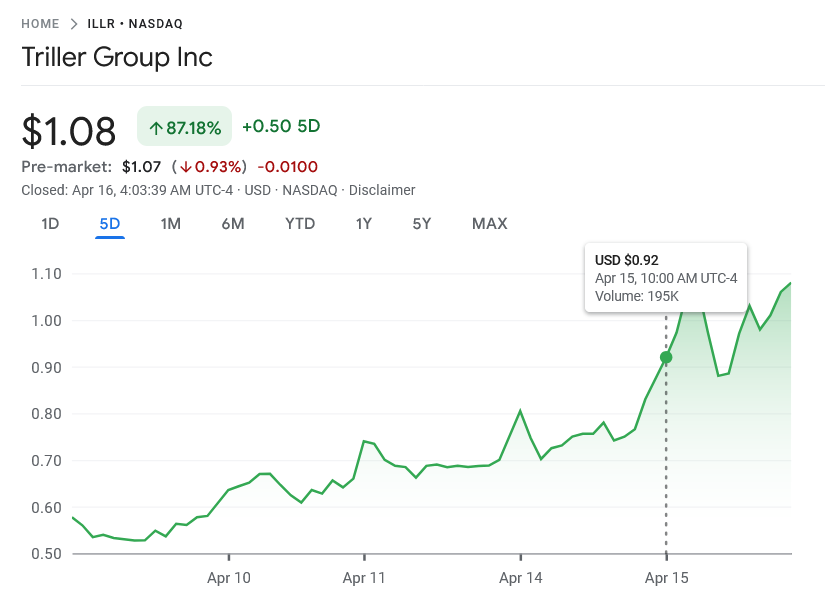

On Tuesday, Triller stock melted up big. Look at the price action over the last five trading days:

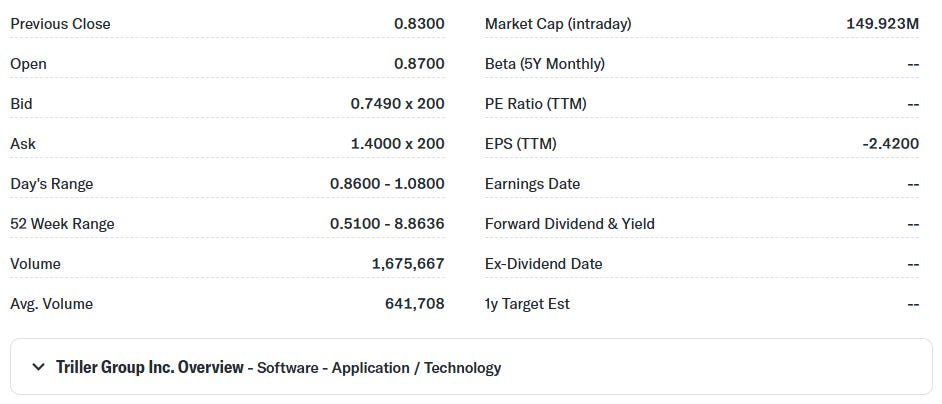

But we also noticed something very curious. Take a look at these statistics from Tuesday’s trading window:

The trading volume was nearly triple the action of what Triller normally trades at for daily activity. A short squeeze? Inside information? Pump and dump? There are a lot of questions to ask.

A prospective battle over Bare Knuckle with multiple creditors

The arrangement between Triller and KCP utilizes a Pledge Agreement to put up BKFC as collateral. This raises eyebrows for a few reasons.

First, there is a significant lawsuit in New York state court involving Yorkville Advisors against AGBA (the shell company that became ILLR). Yorkville allegedly lent AGBA $33.5 million at a very high interest rate and allegedly didn’t receive payment. Yorkville is represented in court by heavyweight law firm DLA Piper.

In the Representations and Warranties section of the KCP Note Agreement, Triller states the following:

(t) Yorkville Note. Except as set forth in Section 2.1(t) of the Company Disclosure Letter, neither the Company nor any of its Affiliates are party to any agreement with YA II PN, LTD (“Yorkville”) or any of its Affiliates other than that certain Amended and Restated Secured Convertible Promissory Note, issued by the Company to Yorkville on June 28, 2024 (the “Yorkville Note”) and the other Yorkville Agreements. Neither the Company nor any of its Subsidiaries owes any costs, expenses or other liabilities to Yorkville or any of its Affiliates, other than the amounts set forth in Section 2.1(t) of the Company Disclosure Letter. Other than with respect to any Liens under the Yorkville Note or as otherwise set forth in Section 2.1(t) of the Company Disclosure Letter, the Company owns such shares of capital stock of Bare Knuckle Fighting Championships, Inc. (“BKFC,” and such shares, “BKFC Shares”) that constitute Collateral (as defined in the Yorkville Note) free and clear of any Liens.

How will the Yorkville lawsuit impact Triller putting up BKFC as collateral to KCP? Who knows, but Triller tries to address this uncomfortable situation in the Covenants section of the KCP Note Agreement:

Section 3.12 Yorkville Matters. The Company shall use its best efforts (i) to satisfy, terminate, discharge and fully release the Yorkville Note and the other Yorkville Agreements (including, for clarity, to cause the release by Yorkville of any Liens under the Yorkville Agreements with respect to the BKFC Shares or any other Collateral (as defined in the Yorkville Note)), (ii) to unconditionally and forever settle any Actions related to the Yorkville Agreements and with Yorkville and its Affiliates (the “Yorkville Litigation”) and (iii) to terminate any Contracts between or among the Company or any of its Subsidiaries, on the one hand, and Yorkville and any of its Affiliates on the other hand, without any remaining or ongoing obligations or liabilities of the Company or any of its Subsidiaries pursuant to the Yorkville Agreements or otherwise, in each case of clauses (i) to (iii), within forty-five (45) days of the Closing Date. The Company shall keep the Purchaser reasonably informed in respect of the foregoing.

To simplify this confusing matter, Triller is raising money right now while attempting to fend off future allegations and claims that the company is utilizing BKFC as collateral in multiple debt financing deals.

If Triller has used Bare Knuckle repeatedly as collateral with multiple creditors to obtain cash, that would be a significant development.

The bottom is sinking in the non-UFC US MMA market

UFC 314 was heralded as a card worthy of hardcore attention. Finally, a modern UFC fight card that was respectable. Intriguingly, early Google Trends revealed good but not great numbers — which may or may not serve as a form of confirmation bias that if you’re into the current UFC product, you’re into it. If you’re not, you’re not.

Will Yorkville be able to obtain BKFC assets in New York state court before Triller files for bankruptcy?

What happens if Triller defaults on its $10M Note with KCP? Here is what Triller states in their Pledge Agreement with KCP for BKFC.

Section 2.09. Intercreditor Relations. Notwithstanding anything herein to the contrary, (a) Pledgor and the Secured Party acknowledge that the exercise of each and every of the Secured Party’s rights and remedies hereunder are subject in their entirety to the provisions of the Giant Wisdom Subordination Agreement and (b) prior to the Discharge of Senior Loans (as such term is defined in the Giant Wisdom Subordination Agreement), any obligation hereunder to physically deliver any Collateral (as such term is defined in the Giant Wisdom Subordination Agreement) to the Secured Party shall be deemed satisfied by the delivery to Giant Wisdom / Giant Wisdom’s Collateral Agent, acting as gratuitous bailee for the Secured Party in accordance with the Giant Wisdom Subordination Agreement. The failure of the Secured Party to immediately enforce any of its rights and remedies hereunder (as a result of the terms of the Giant Wisdom Subordination Agreement or otherwise) shall not constitute a waiver of any such rights and remedies. In the event of any conflict or inconsistency between the terms of the Giant Wisdom Subordination Agreement and this Agreement regarding the relative priorities of the Giant Wisdom in the Collateral, the terms of the Giant Wisdom Subordination Agreement shall govern and control.

Translation: Giant Wisdom has higher priority.

What the Agreement promises, however, is a freeze on future borrowing against the BKFC assets, with KCP having BKFC as collateral for their $10M note.

Section 9.03. Sale of Collateral. (a) Without limiting the Secured Party’s right to pursue other remedies, if any Pledgor defaults in any provision of this Agreement, or any other Event of Default shall have occurred and be continuing, the Secured Party may sell the Pledged Collateral, or any part thereof, at public or private sale or at any broker’s board or on any securities exchange, for cash, on credit, or for future delivery, as the Secured Party shall deem appropriate. The Secured Party shall be authorized at any such sale (if the Secured Party deems it advisable to do so with respect to any Pledged Collateral) to restrict the prospective bidders or purchasers to Persons who will represent and agree that they are purchasing the Pledged Collateral for their own account for investment and not with a view to the distribution or sale thereof, and upon consummation of any such sale the Secured Party shall have the right to assign, transfer and deliver to the purchaser or purchasers thereof the Pledged Collateral so sold.

Can Triller find extra financing to settle with Yorkville to remove any of their potential ownership claims on BKFC assets?

What happens to BKFC if/when Triller files for bankruptcy? What will BKFC Founder/President Dave Feldman do next? Can a third party arrange financing to grab BKFC or its IP away from Triller?

The debt clock is ticking.

Zach Arnold is a lead opinion writer for The MMA Draw on Substack. His archives can be read at FightOpinion.com.

I suspect that’s why they were over in Dubai.