TKO ramps up M&A spending spree with AAA acquisition

'They want everything.' First it was AAA. Watch out for TNA & New Japan.

Earlier in the week, I received a phone call from an active source currently navigating the American sports M&A (mergers & acquisitions) landscape.

The source made it clear to me that AAA, the long-time Lucha promotion in Mexico, would finalize a deal with WWE. I wasn’t surprised, but there had to be more to this story. What was I missing?

AAA has long languished as an important player in Lucha, even with their TripleMania event maintaining good marquee promotional value. It’s a terrible product. That’s why I underestimated the news value of this story.

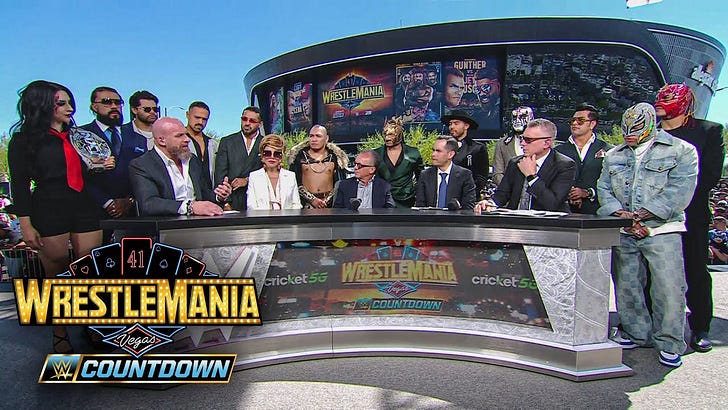

I figured some sort of announcement would be made after WrestleMania. I was surprised by the urgency of Saturday’s presentation.

For better and for worse, AAA is a classic example of a distressed asset. A legacy name in professional wrestling in a market where TKO wants to be. WWE is not getting CMLL (Consejo Mundial de Lucha Libre), but they can easily grab the next best brand. And so they did.

The AAA acquisition is not a surprise. The surprise is that the news didn’t leak out sooner. If I heard about it privately, you better believe other major key players in the fight industry knew as well.

My mistake? I misjudged the public reaction to the announcement given AAA’s current state of affairs. I didn’t fully appreciate the scope of the impact that WWE’s announcement would generate.

Now it’s time to discuss the rest of the story.

TKO & WWE are moving into a very aggressive mode for strategic mergers & acquisitions. In combination with Netflix's emerging market & increased spending targets, TKO is calculating which markets to specifically target based on both TKO’s growth and Netflix’s need for subscriber growth.

Mexico is the first key market, as the AAA acquisition highlights. Another key piece of the puzzle has been the acquisition of Stephanie Vaquer, a former CMLL champion who has naturally dominated NXT and is primed for a big run.

India is the second big target market. Nick Khan is aiming to build promotion for a WWE PLE (Premium Live Event/PPV) in the country. Netflix recently stepped up its footprint in the country and has been promoting TKO crossover ventures non-stop, as highlighted in this recent video:

Japan is a third key market. This is more of an intricate puzzle to solve. Current estimates are approximately 7 to 8 million Netflix subscribers in a country of 120 million people.

Growing the Netflix profile in Canada is also critical. Current estimates for Netflix subscribers range between 6 to 7 million, which is good but not dominant in a country with 40 million plus citizens.

As of Friday, Netflix is no longer releasing subscriber information, so everything is an educated guess from this point moving forward.

Netflix wants long-term subscriber growth and also wants TKO to be the tip of the spear to generate new subscribers in global markets. Their content spend is increasing rapidly, especially with Netflix stock closing last week at the $1,000 mark.

Which is why TKO is interested in acquisition targets like New Japan and, to a lesser extent, TNA. Supposedly, there may be some interest in Bare Knuckle as well, but that’s a much more complicated scenario.

You would have thought that paying $375 million in an UFC antitrust case would have slowed TKO’s acquisition momentum. That is not the case with Donald J. Trump in the White House. It is full steam ahead.

10 major initial takeaways from UFC antitrust lawsuit settlement

So much for my concept of writing 10 articles about an upcoming UFC antitrust trial and all the various legal arguments that such a trial would have entailed. Instead, we’ll spend plenty of time writing 10 different articles about what the settlement reached on Wednesday between TKO & the fighters means.

TKO wants to make as many acquisitions as quickly as possible in boxing and professional wrestling. They’ve already wrapped up the MMA market and now want to use the same playbook for other fight sports.

Professional wrestling, not MMA, is now the most important part of TKO’s growth portfolio. It is what they — and Netflix — believe is the key driver for increasing exposure in critical markets for advertising revenue.

Distressed assets like TNA, New Japan, and Bare Knuckle fit the bill perfectly for the multi-monopoly.

In my 25+ year sportswriting career, I’ve built a reputation for spotting distressed assets in the fight business early and analyzing the possibilities they present to potential acquirers.

Let’s look at potential targets for TKO acquisitions and why it makes sense to buy everything now.

Sending a message to financial institutions

“No one else can make money at this, so don’t bother investing in any other fight projects.”

That’s a key message that TKO is sending to major institutional financiers with their recent moves. Look at Donn Davis. Look at the risk profile. We’re the only ones who cracked the code to do this stuff profitably.

In one regard, TKO is not wrong. PFL, being hundreds of millions of dollars in debt, has been alarming and eye-opening to private equity and big banks. How do you defend it? You can’t.

If Donn Davis can’t make it work, no one else can.

That’s the roadblock any prospective acquisition play in the fight business has to surmount. Just trying to explain why Donn Davis has been a massive failure is a feat in and of itself. I can explain it away, but how many outsiders can explain it to a banker in 30 seconds? Good luck with that.

For TKO, buying out the competition isn’t simply about growth. It’s about eliminating the competition for both market share and financing.

Once TKO buys out key assets in Japan, Mexico, Canada, and other important markets, it will begin a systemic destruction of any independent actors. It’s their billions of dollars in process power versus national promotions that may produce better shows, but have nowhere near the capital to fight off a globe-conquering behemoth.

Given the current occupant at 1600 Pennsylvania Avenue, TKO has the green light to raid every market and every promotion. The current path of aggression will make Vince McMahon’s raiding of the wrestling territories in the 1980s look like child’s play.

The reason TKO is such a content mill for production is that’s what big financiers and media executives want to see. They have never understood or appreciated the past systems that made big fights so popular in global culture.

What executives want is predictability. What they want is weekly programming, preferably live. What financiers want is guaranteed money. They have zero appetite for promoting a business that historically has ridden boom-bust cycles. Wall St. has zero appetite for an industry with a 95% risk profile. They have zero comprehension of an industry that, prior to monopolization, produced big events and then took weeks, if not months, off to recover and refresh.

The reality is that Vince McMahon created the modern-day blueprint for all fight sports media rights with his Monday Night RAW format.

The bottom is sinking in the non-UFC US MMA market

UFC 314 was heralded as a card worthy of hardcore attention. Finally, a modern UFC fight card that was respectable. Intriguingly, early Google Trends revealed good but not great numbers — which may or may not serve as a form of confirmation bias that if you’re into the current UFC product, you’re into it. If you’re not, you’re not.

This is why TKO’s one-size-fits-all approach to content development is hard-wired into Hollywood’s head. They simply see a ring or a cage as a stage. They see talent as disposable. As long as brand building and promotion of Intellectual Property is priority number one, talent barely matters. This is the language that financiers like Bank of America CEO Brian Moynihan and JP Morgan Chase CEO Jamie Dimon understand.

Executives care about process, not substance; predictability, not drama and intrigue; and First Mover status over first-class fights.

What they also care about is an economic moat. TKO is suffocating competition through market share and financing. Now comes the Mergers & Acquisitions part of the puzzle.

In a couple of days, there will be a corporate celebration of the second anniversary of the WWE + UFC merger announcement on CNBC. In future articles and podcasts, we will review what has transpired over the last two years and what TKO’s next steps are over the next five years to completely swallow up the fight sport landscape before they likely sell part — or all — of their operations.

The next step for TKO is to buy as many distressed assets in key international markets where they and Netflix want to grow.

The value of Joint Ventures

Given WWE’s recent antitrust settlement with Major League Wrestling, the obvious question is why would TKO want to stir up a hornet’s nest?

They don’t have to worry about strategic asset purchases if they’re part of a joint venture with another party.

Read carefully how the AAA news was presented by WWE in their announcement:

"WWE is announcing the acquisition of Mexican Lucha Libre promotion AAA. The acquisition is in partnership with Mexico-based sports & entertainment holding company Fillip."

Alberto Fasja Cohen, co-founder of Fillip, was on the Wrestlemania set for a reason.

Mr. Cohen is a senior advisor at General Atlantic, which has investments throughout Latin America.

WWE wants strategic partners. They want markets. They want to buy big brands and IP. They don’t want to make the mistake of “NXT Japan” or “NXT Mexico.” As a multi-national, TKO wants familiar local brands that they own pieces of to build a promotional and content network.

JVs (Joint Ventures) skirt around some delicate business and legal issues.

Joint Ventures are the framework to focus on regarding future asset deals with TKO.

Which leads us to the pros and cons of various distressed assets currently in the fight market.

Scenario number one - TNA

The zombie wrestling promotion that won’t die could use a helping hand.

Len Asper, whose CanWest family fortune helped fuel Anthem Sports & Entertainment, could use a strategic partner. Whether it’s TKO or Patrick Whitesell’s new Silver Lake-backed sports financing venture, Anthem is primed for investment.

Whether that investment is directly into Anthem or facilitating a sale of assets, that remains unknown. Asper recently purchased the Brampton Honey Badgers team in the Canadian Elite Basketball League. His brother owns the Winnipeg Sea Bears.

Anthem Sports & Entertainment purchased film distributor Gravitas Ventures in 2021, only to recently sell it to Oaktree-backed Shout! Studios.

The turnover of management personnel in TNA under Asper’s tenure has been astounding. The company has a deal with Endeavor Streaming, and recent arena numbers for bigger events have increased. The soft partnership with NXT/WWE has juice. TNA grabbed WWE’s old Sportsnet 360 slot after RAW went to Netflix.

The biggest mystery regarding TNA ownership under Asper’s tenure has been the company’s identity. TNA never bothered marketing itself as a strong Canadian company in a major North American media market like Toronto. The growing value of TNA is not only as a talent pipeline to WWE, it’s the potential to grow the brand as a preeminent powerhouse in a country that loves fight sports and always punches above its weight.

The minute former World Series of Fighting executive Carlos Silva was brought into the fold, eyebrows were raised. Was he there to help TNA grow, or was he there to clean house and be the caretaker to prepare TNA to be purchased?

Scenario number two - New Japan (or NOAH)

Conquering the Japanese professional wrestling scene has been the Holy Grail for Vince McMahon since the 1980s. He repeatedly tried — and failed.

But organized crime has faded away from the Japanese scene, and now the wrestling business in Japan looks and acts a lot like America. The yakuza muscle needed to reject outsiders is long gone.

ABEMA going all-in with WWE for RAW, SmackDown, and big events like WrestleMania cemented a path for WWE to gain market share in the country.

WWE & UFC looking to TKO Japan with new ABEMA & U-NEXT TV deals

Ari Emanuel knows how to pick the side of any business deal with the biggest margins by playing multiple partners against each other.

The most important information to remember regarding the two Japanese men’s wrestling brands is that both have ties to TV-Asahi.

Asahi has 10% ownership in New Japan and airs their weekly TV show. Plus, there’s NJPW World. Bushiroad is the majority owner of the New Japan and Stardom brands.

Asahi owns a third of ABEMA, the digital platform run by CyberAgent. CyberAgent is the backer of NOAH. It’s a big digital rights player in Japan.

UFC airs on ABEMA’s rival, U-NEXT (backed by Tokyo Broadcasting System).

Netflix Japan recently made a big splash with professional wrestling fans with their Dump Matsumoto five-episode series called “The Queen of Villains.”

The environment is primed for WWE to reach a joint venture deal.

NOAH makes sense as a second brand in Japan, similar to AAA in Mexico. Naomichi Marufuji and Keiji Muto are key emissaries for ABEMA with WWE. Both are in Las Vegas for WrestleMania right now. A joint venture between CyberAgent and WWE has long been teased. The company is gaining traction with wrestling fans in 2025 with their new ace, (Taishi) OZAWA. NOAH makes sense as a WWE partner.

However, New Japan is a bigger brand with more international recognition. It’s always been a prime target for partnership or acquisition, as we’ve seen in the past with WCW and Tony Khan’s All Elite Wrestling.

AEW has bought out so many of their wrestlers that New Japan has struggled to keep talent. This game of attrition has also cost New Japan talent that’s gone to WWE. The latest hiring is Jeff Cobb, a dynamic big-man athlete.

The great irony in this scenario is that Tony Khan’s talent raids on his “friend” New Japan increased the odds of that organization tying up with WWE.

WWE entering into a joint venture with CyberAgent or TV-Asahi for New Japan would be both a personal and professional blow against Tony Khan. It would also end his Forbidden Door AEW/New Japan PPV concept.

The big question is how Bushiroad would respond to WWE overtures for New Japan.

New Japan is in a difficult spot, especially developing a platform for talent regeneration that can draw major arena-level crowds. The operation finds itself in a position as weak, if not weaker, than the one it was in in the mid-2000s.

Bushiroad is a publicly traded company, so turning down legitimate offers from TKO will be challenging.

WWE’s media rights deal with ABEMA expires soon. With Netflix Japan on the horizon, there are some big decisions that Asahi and CyberAgent have to make. It is in TKO’s best interests to have both Asahi and Netflix Japan promoting their content in Japan. A WWE plus New Japan package could work.

Scenario number three - Bare Knuckle

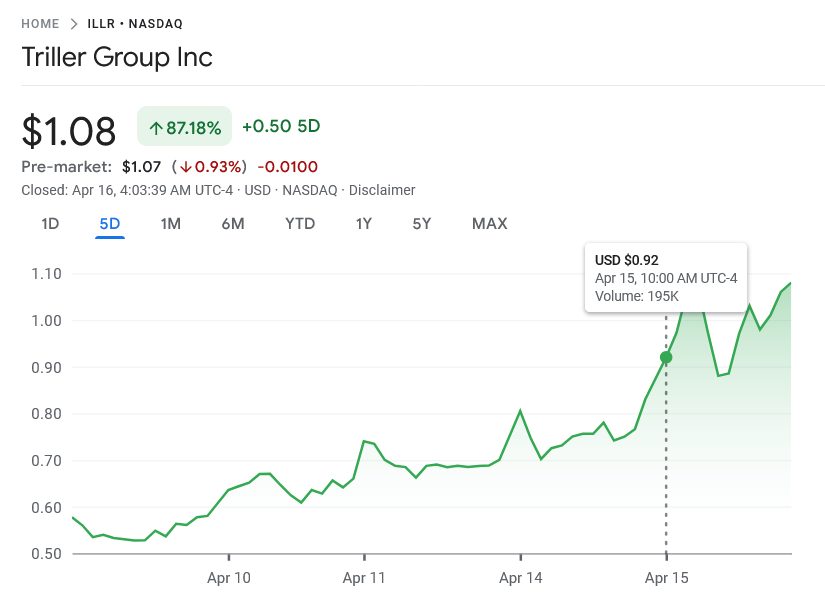

We have chronicled the recent financial struggles of Triller, the majority owner of Bare Knuckle FC.

Triller offers BKFC as collateral for $10M convertible note

Now we know why Triller filed an NT 10-K with the SEC to delay their annual earnings report.

Our recent reporting shows that it is a race against the clock to see who ends up with custody of BKFC. Will Triller be able to keep its ownership stake?

Upon information and belief, it is believed that top creditor Yorkville Advisors will argue in New York state court next month that time is up for AGBA/Triller to pay back their high-interest note and that Yorkville will claim a right to a lien on the BKFC assets.

Avoiding a bankruptcy scenario, the obvious play would be for TKO — or one of their business partners — to broker a settlement that gets Yorkville to release their claims against Triller and BKFC in exchange for the BKFC assets being transferred to a third party.

The question is whether Yorkville is the only creditor that Triller has promised BKFC to for collateral to obtain financing.

Should Triller end up in bankruptcy court, the ownership rights to BKFC will get very messy, and it would be more challenging for an outside entity like TKO to get the BKFC IP in an auction.

But why would TKO want BKFC, given their current M&A strategy in coordination with Netflix? BKFC won’t bring new subscribers to Netflix. So what’s the point?

BKFC is not a product for Netflix but it certainly could work for Fox Sports 1 or another outlet as cost-effective, reliable programming.

If it wasn’t for the insane amount of debt — and Thai military ties — in Chatri’s ONE Championship, ONE would be an excellent target to help TKO break into the Thai market.

The point of TKO (or a third party in a joint venture) acquiring BKFC is simple. It is a growing brand. It’s a better play than PFL. There’s plenty of event inventory. The video library is growing. There are many big markets yet to be opened. Dave Feldman is a diehard promoter. It’s a brand that can shuffle talent in and out quickly for a big celebrity fight. It’s not as expensive as a traditional MMA play. It fits right into the Bro Vote that watches UFC. It’s a product with a good chance of exportability into different countries.

Bottom line? It’s entirely a buyer’s market right now for TKO. There are lots of distressed assets in the fight business. And they are preparing to move quickly, with strategic partners in the fold.

Zach Arnold is a lead opinion writer for The MMA Draw on Substack. His archives can be read at FightOpinion.com.

Crazy how fast you got this piece out. So much detail.

The BKFC section is hugely interesting given that Triller Group is up 57% in the past week (includes down 17% today). The information about a creditor possibly forcing a sale of BKFC is wild.

Again, cracking good journalism & info!