The hidden secrets of UFC & WWE's magic formula

Endeavor tries to run out the clock before revealing the goods.

How do they do it?

How does Endeavor, the Hollywood giant behind TKO which owns UFC & WWE, make so much money while producing such lousy and inconsistent fight cards lacking depth of talent?

No one else has been able to make billions of dollars in the fight business using the “THEY FIGHT!” model. Before TKO existed, you had to actually promote marquee attractions to make some coin.

So, what’s the secret sauce? Why hasn’t anyone else been able to replicate this?

Endeavor doesn’t want the public to know what they label “trade secrets” and is fighting tooth-and-nail against showing their homework before the publicly traded company goes private and no longer has to reveal its books.

Two legal cases threaten to bring transparency to how Ari Emanuel and Mark Shapiro have been able to make billions of dollars. The question is whether or not Endeavor can run out the clock.

The ‘book battle’ in Delaware: Endeavor vs. Hedge Funds

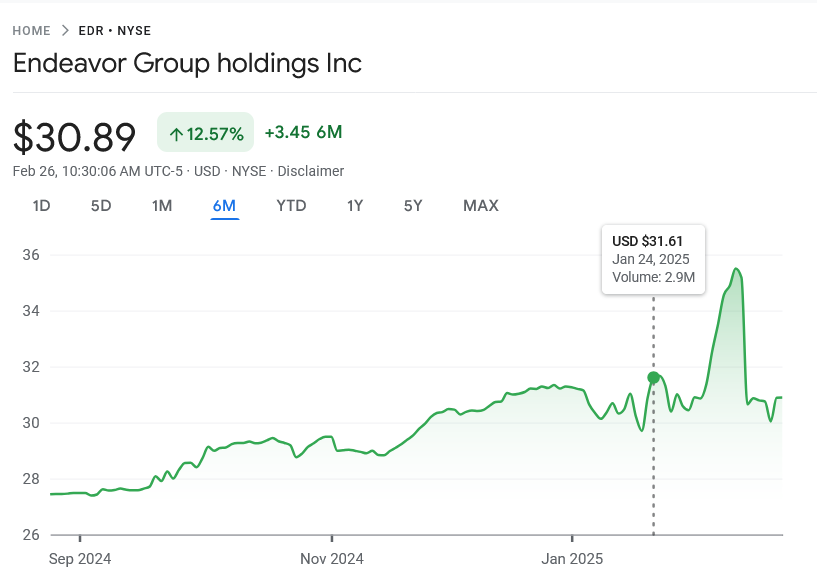

When Endeavor publicly made their intentions clear about leaving Wall Street, the company announced a take-private price of $27.50 for Silver Lake, Mubadala, and other financiers to buy EDR stock from shareholders. At the time, it represented an approximate 10%-ish over-market price tag.

But then a funny thing happened. Endeavor management started gobbling up more and more shares of TKO stock. As their ownership in TKO stock grew, so did the price tag of TKO stock itself. And that, in turn, significantly raised the price of Endeavor’s publicly-traded stock shares.

Oops.

As this chart reveals, Endeavor’s stock price has climbed over the last six months. At its peak, it was $35 dollars a share. That’s a lot higher than the take-private negotiated price of $27.50 a share. This raised a lot of eyebrows, especially with big institutional investors like hedge funds.

As a result, there have been multiple hedge funds ready to threaten litigation against Endeavor. The magic phrase is shareholder derivative lawsuit. In other words, did Endeavor fully meet its obligations to shareholders by getting the best take private price?

Right now, that’s a tough argument for Endeavor to make.

The financial bloodhounds are sniffing around for certain information. What do they think is being hidden? Let’s follow their trail.

Keep reading with a 7-day free trial

Subscribe to The MMA Draw Newsletter to keep reading this post and get 7 days of free access to the full post archives.