UFC admits to ‘lower' fighter pay during ‘best financial year’ ever

UFC broke a slew of records again. Bloody Elbow takes a look at financial figures from Endeavor’s SEC filings and earnings call.

Endeavor Group Holdings, the parent company to the UFC, recently released their 4th quarter and full year earnings for 2022. For the full year, they saw $5.268 billion in revenue, up $190.4 million over 2021, and their adjusted EBIDTA was $1.164 billion, up $283.2 million year-over-year. Endeavor also noted that they had made $500 million in discretionary debt payments, bringing its total long-term debt down from $5.63 billion at the end of 2021 to $5.17 billion.

In both their 8-K and 10-K filings with the SEC and on their earnings call to investors, Endeavor went out of its way to highlight how well the UFC did last year, and how important it was to the overall company’s success. Since Bloody Elbow is a combat sports site that caters mostly to MMA fans, we are going to focus on what we can glean about the UFC’s finances from these financial disclosures.

UFC makes up most of Endeavor’s Owned Sports Properties

While Endeavor’s filings with the SEC did not give any granular details about the UFC, it did report on last year’s performance by the Owned Sports Properties segment, which is made up of the UFC, PBR bull-riding and Euroleague basketball (as well as for a portion of last year, Diamond Baseball Holdings, a collection of 10 minor league teams that Endeavor sold in August.) Last year the entire Owned Sports Property segment generated $1.332 billion in revenue, an increase of $224 million from the previous year. It also reported an adjusted EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) of $648 million, an increase of $111 million from 2021. The EBITDA margins also ticked up slightly, from 48.5% in 2021 to 48.6% in 2022.

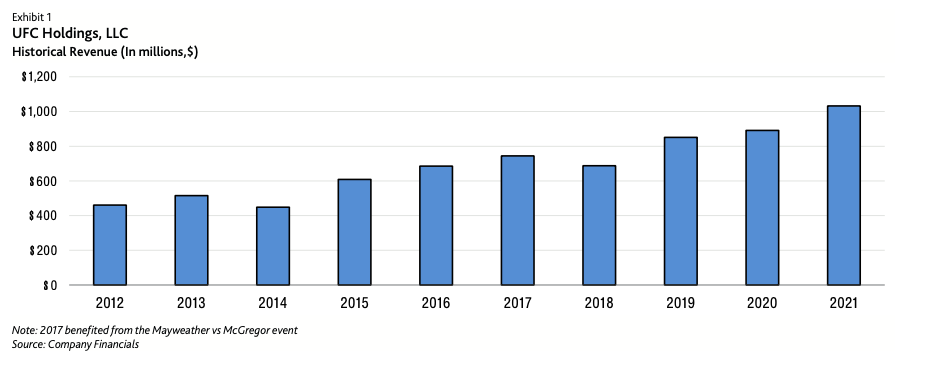

While Endeavor’s SEC filing did not reveal how much the UFC was responsible for those numbers, we have an idea based on what the credit rating company Moody’s has reported on the UFC’s finances. In 2019 Endeavor reported $935 million from their Owned Sports Properties. For that same year Moody’s reported that the UFC had generated approximately $860 million in revenues, or 92% of the segments revenues. In 2020 Owned Sports Properties saw $953 million in revenue and the UFC around $890 million, or 93% of the revenues. And in 2021 Owned Sports Properties had $1.108 billion in revenue and the UFC approximately $1.020 billion, or 92% of all the revenues.

Best financial year ever for fourth consecutive year

In 2022, Owned Sports Properties reported $1.332 billion in revenue, with the increase from 2021 being driven in large part by the UFC “due to increased media rights fees, greater sponsorship, licensing, commercial PPV and event related revenue from more events with live audiences.”

Endeavor’s 10-K informs us that Diamond Baseball Holdings was responsible for $64 million of Owned Sports Properties revenues. Since this entity was not part of the segment in previous years, we can deduct their portion to get $1.268 billion in total revenue from the UFC, PBR, and Euroleague; the three entities that made up the segment in previous years. If we assume that the UFC was again responsible for no less than 90+ percent of the revenue than the UFC can be expected to have generated at least $1.14 billion last year.

This amount for the UFC would line up with Endeavor’s statement that the company “posted its best financial year ever for the fourth consecutive year.” This best year came with a slew of records broken, including revenue, sponsorships, consumer products (“most notably within the video game, trading card, and NFT categories”) and the highest grossing Fight Nights in company history, both globally and in the U.S.

For sponsorship in 2022, UFC had its highest sales in the company’s history. According to CEO Ari Emanuel, the UFC went “from eight figures to nine figures.” Amongst the new sponsors added to their roster was the blockchain platform VeChain, New Amsterdam Vodka (“the Official Ready to Drink Vodka of UFC”) , and Dwayne Johnson’s Project Rock along with new categories like the official electric commercial truck and the official law firm.

While the current ESPN broadcast broadcast deal still has two more years left, the UFC renewed ten of their international media rights deals in 2022. These renewed deals saw their overall average annual value more than double over the prior deals. During their earning call, Endeavor pointed out, as an example of how much demand there was for the UFC internationally, that there were six bidders for their UK rights.

Live events were also a strong point for the UFC, with all 21 of their events with live audiences selling out. This included “four of the highest grossing fight nights in the U.S. and the two highest grossing fight nights in UFC’s history, both at London’s O2 Arena.” Site fees, which the UFC collected on events from Singapore, Perth, Abu Dhabi, and Utah, were highlighted as something that potentially provided high margins and that the company was looking “to have high margin site fees for three to four of our live events “ in 2023.

Expenses

In addition to higher revenues last year, direct operating costs for Owned Sports Properties were also up $54.1 million, or 14.2%, from 2021, totaling $433.8 million. The higher direct operating costs were credited mostly to expenses connected to the increased number of live UFC and PBR events as well as costs for the seven months Endeavor ran the Diamond Baseball Holdings. It was also noted by Endeavor that these increases in direct operating costs were “partially offset by lower athlete costs for UFC.”

Based on comments by Endeavor executives, we estimated that total fighter pay in 2021 was $178.8 million or 17.5% of the UFC’s revenue. This falls right in line with what we know about the share of revenue the UFC paid in the past and what they projected they would continue to pay after their sale in 2016.

Operating costs were “partially offset by lower athlete costs for UFC.”

If UFC’s total athlete pay was just 1% lower in 2022 than it was in 2021, and their revenues ended up being $1.14 billion, then the fighters’ share of revenue would have been only 15.5% last year.

Of course, if fighter pay was lowered more than 1%, their revenue share would’ve been even more lopsided in the company’s favor.

Keep reading with a 7-day free trial

Subscribe to The MMA Draw Newsletter to keep reading this post and get 7 days of free access to the full post archives.