10 major initial takeaways from UFC antitrust lawsuit settlement

Barring surprises in future legal disclosures, TKO has cemented its path to permanent dominance.

So much for my concept of writing 10 articles about an upcoming UFC antitrust trial and all the various legal arguments that such a trial would have entailed. Instead, we’ll spend plenty of time writing 10 different articles about what the settlement reached on Wednesday between TKO & the fighters means.

In the mean time, you deserve to at least have a bigger picture summary of what this antitrust settlement means and how it will impact you as a fight fan.

There’s a lot of emotional responses to what appears, on the surface, to be a rather anticlimactic conclusion to a decade-long legal challenge that no one saw progressing the way it played out in Las Vegas.

The UFC antitrust settlement creates room for some new and unexpected drama. Plus, it requires a fair amount of historical reflection on how we got to this point, why we di, and where we go from here.

One guarantee is for sure: the fight business under Ari Emanuel just got a hell of a lot more political. For sports and entertainment fans who don’t want to see politics enmeshed in their TV product, combat sports is not going to be suitable for you.

Here are ten angles (plus a bonus topic) we are focusing on after the UFC antitrust settlement.

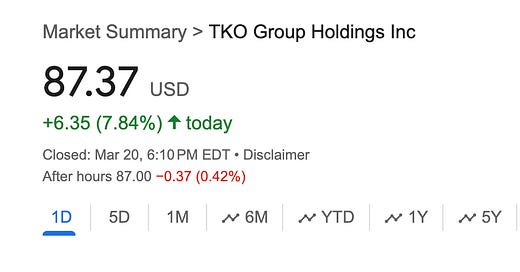

TKO’s story just became a lot more compelling to Wall Street

Until Endeavor purchased UFC, no one was ever truly able to make a compelling business argument that you could de-risk a combat sports enterprise. A business with a failure rate of over 99%? And yet here we are. Ari Emanuel has not only de-fanged risk in combat sports, he turned the entire business model upside down.

UFC generates over a billion dollars a year. WWE generates over a billion dollars a year. Their government contracts are growing. Their sponsorship numbers are growing. Their media contracts are growing exponentially. There is as much guaranteed revenue for TKO as there is for a Treasury or a municipal bond.

This isn’t supposed to happen.

For veterans of the combat sports space, please forgive investors for being shocked and awed.

The biggest risk to TKO has not been financial. It been legal.

The UFC antitrust settlement is a huge domino to fall. It’s a huge worry eliminated. Ari now has a much better story to tell Wall Street analysts and hedge funds who aren’t combat sports geeks. With most of TKO’s revenue guaranteed, analyzing what TKO is and what it isn’t is a whole lot clearer.

Ari Emanuel has a love/hate relationship with the Street because of his view that no one fully understands what Endeavor is worth and why he values it much more than investors.

That’s not true of TKO. The raw business and cultural power of UFC & WWE is easy to understand. They are growth properties in a world full of uncertainty. They’re filthy rich cash cows and the gravy train isn’t stopping any time soon.

The biggest legal threat is still to come — and that’s Vince McMahon’s situation.

But, the antitrust trial was by far a more serious process threat to the UFC part of the business. With that uncertainty removed, expect a lot more bulls on TKO stock. A higher stock price means a higher valuation for TKO and it means Endeavor gets more money in prospective management fees, dividends, and stock buybacks

.

Endeavor will increase its full control of the combat sports ecosystem

With Endeavor’s consolidation of complete and total market share dominance in combat sports and sports entertainment, the next step is to develop control from the ground floor up to the C-suite.

What would control look like? Control would look like TKO having their hands in every step of combat sports delivery but with the lowest possible exposure to risk.

Let’s game this scenario out.

Keep reading with a 7-day free trial

Subscribe to The MMA Draw Newsletter to keep reading this post and get 7 days of free access to the full post archives.